211015 Update Hong Kong Dividend Growth Stocks

This is the newsletter you get if you sign up (FREE) below to see the stock screeners favorite this week. You also get to immediately download the 25 highest yield Dividend Growth Stocks.

If you need a deeper level and full spectrum of all Dividend Growth Stocks and Blue Chip Stocks of Hong Kong including the stock screener to optimize your (or your clients portfolio), it is recommend to become a Champion member.

Here is your quick dose of the Hong Kong Dividend stock updates and your new Free updated 25 highest yield dividend growth stocks. (Scroll down and hit the blue or the green button)

A quick reminder:

All Hong Kong Dividend Growth stocks that are eligible to be an entry in the Directory for Champion Members they must have:

- 5 years or more of dividend increases

- 5 yr dividend growth rate of 0.001 or higher.

Reading time of this email: 2 minutes.

– What happened last week? Blue Chip Liabilities THIS IS BIG

– The stock screeners favorite this week

– The 25 highest yield dividend growth stocks, what stands out?

– Hong Kong Dividend Growth Stocks averages on October 14, 2021:

– Great links you can not miss out on

– What happened last week?

Did you read the update of The Dogs of the Hang Seng already? Better see it here

This week we looked in to the Blue Chip Companies and did some digging into their liability ratios. Of course after the fall Evergrande and others, it helps to look into the debt of the big companies. The idea was to write this in an easy follow manner and still deliver a clear insights of which of the Hong Kong Blue Chip companies might be over leveraged.

This resulted in a uber-easy to understand report. You can download the .xls file here The colors show who has their ship in order.

For Champion members: the above report will not be sufficient for your inquisitive minds. On the members page you will find the Blue Chip Value file. Added there are 4 columns with the exact ratios. Here also color is added to get through it fast.

If you have a question, just reply to this email.

What else: The Stock Screener likes: China Gas Holding HKG:0384 We are still in anticipation of the interim result of the 6 months ending September 30, 2021. The Stock Screener points out this is a perfect example where yield is not too high and the true power comes from the Dividend Growth Ratio. This shows in the years it takes to get to 10% Yield on Cost.

- Yield 2.5%

- EPS 2.00

- P/E 10

- Year to 10% YoC: 7 years

- Payout Ratio 10%

- 5-yr average Dividend Growth 23%

If this does not get you warm, than just stare at their Beautiful Chart… Pure inspiration

For Champion Members: In the Directory file, where all Dividend growth stocks are kept, you can put a filter on the column Value. Select 70, 80, 90 and 100. This will give you and idea which companies might be having their stocks at a favorable price.

-Compared to last week:

Biggest riser in stock price was Min Xin Holdings HKG:0222 picked up 30%.

Looking to buy in the dip, this might be an interesting one: HKG:0956 Sun Tien Energy stock went down 19%.

-The 25 highest yield dividend growth stocks and the Directory for Champion members, what stands out?

This week something extra in the list of 25 highest yield Dividend Growth stocks.

-PAYOUT Ratio.

This metric tells us how much of net income is paid out in dividends. We aim for anything under 50-60%. In ideal situations, net income should be used to pay dividends, but also to invest in a way that creates more income next year, so we can get more dividends.

If this ratio is too high next year dividends payouts might be in trouble.

The Payout Ratio is a part of the metrics used to calculate RISK, in the triangle of Growth | Risk | and Value of a dividend stock.

See which of the 25 have a favorable pay out ratio here to download

Hong Kong Dividend Growth Stocks averages on October 14, 2021:

Of all Hong Kong Dividend Growth stocks, the averages are:

- The average yield of all companies in the Directory is 5.37% . Last week average yield was 5.25%

- Of all these stocks the average 5-year-average-dividend-growth is 21.97%

- 1-year-average Dividend growth is 14%

- When we do: yield 5.31% x growth 21.93% => 10%-Yield-on-Cost will be in 5 years.

- Average Price-to-Earnings ratio (P/E) is: 12.15, last week PE was over 12.33

- Average Earnings per Share (EPS) is: 1.153

Great links you can not miss out on:

- The latest top 10 Highest yield Dividend Growth stocks

- Upcoming Ex-Dividend dates this week

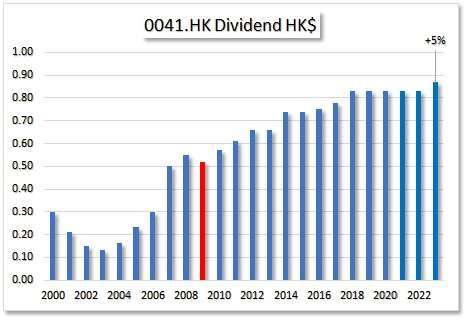

- Watch some Beautiful Dividend Charts

- How to Become a Champion Member and see all?

- If you are ready to take your long term investment research to the next level, I strongly recommend, you become a Champion Member. See all HK listed companies that can bring passive cash-flow.

If you have a question, recommendation, or bright idea, be sure to let me know.

Just reply to this email.

Wishing you a happy day,

Petra @ Hong Kong Dividend Stocks

Twitter and Facebook.

Click and keep in touch easily with HKDS!

|

Start here:Your FREE Dividend Growth and Blue Chip kit |

|

|

YES, FOR FREE No spam, promise! |