211008 Update Hong Kong Dividend Growth Stocks

This is the newsletter you get if you sign up (FREE) below to see the stock screeners favorite this week. You also get to immediately download the 25 highest yield Dividend Growth Stocks.

If you need a deeper level and full spectrum of all Dividend Growth Stocks and Blue Chip Stocks of Hong Kong including the stock screener to optimize your (or your clients portfolio), it is recommend to become a Champion member.

A quick reminder:

All Hong Kong Dividend Growth stocks that are eligible to be an entry in the Directory for Champion Members they must have:

- 5 years or more of dividend increases

- 5 yr dividend growth rate of 0.001 or higher.

Reading time of this email: 2 minutes.

– What happened last week? It involves dogs

– Blue Chip Companies, an opportunity arises?

– The stock screeners favorite this week

– The 25 highest yield dividend growth stocks, what stands out?

– Hong Kong Dividend Growth Stocks averages on October 8, 2021:

– Great links you can not miss out on

– What happened last week?

The Dogs of the Hang Seng got an update. Remember the 10 Blue Chip companies that had the highest yield on January 1? They are still winning. That portfolio is up 17% and that is without taking the paid dividends in account. Better see it here

Talking about the Hong Kong Blue Chip Companies. One that might be more attractive than ever is Tencent. They are at -40% of their 52-week low. Average Dividend growth 5-yr is 28% . It would take 11 years to get to 10% yield on Cost.

Blue Chips hardy come cheap. That is why book value (444% over valued) and Graham number (218% overvalued) are not even close to the price.

The Tencent liability related ratios are okay.

- Cash/Short term debt: 12 (>1 is okay)

- Total Liabilities/Assets 0.42 (most of us like < 0.5)

- Net Debt/equity 0.43 (< 1 is okay)

- D/E interim balance 0.7 (<1.5 can be good already)

What else: The Stock Screener likes Puxing HKG:0090

- Yield 10%

- EPS 0.33

- P/E 2.94

- Interim growth in EPS (YoY) 9%

- Payout Ratio 30%

- 5-yr average Dividend Growth 36%

-Compared to last week:

Biggest riser in stock price was Lenovo HKG:0992 picked up 10%. They might be on to a good year! Yield for this Dividend Contender is ~3.3%.

Looking to buy in the dip, this might be an interesting one: HKG:0868 XinYi Glass stock went down 9%. This price laps caused the yield to go to almost 3.50%. Dividend Payout looks healthy. But still the Price to Book ratio might be critical. Maybe the dip is not at its deepest..

Champion Members in your file you will see another stock that dropped almost 10% (and it is a Blue Chip too). I marked it in green for you.

-The 25 highest yield dividend growth stocks and the Directory for Champion members, what stands out?

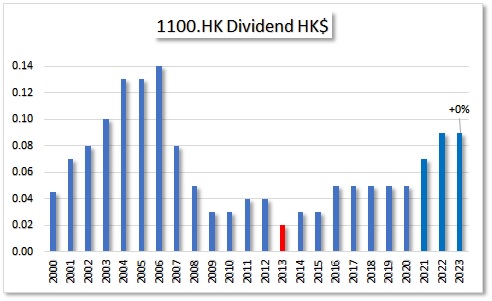

Last email I pointed out which companies are in this list but did cut their interim dividend. You can see them all so far here

Hong Kong Dividend Growth Stocks averages on October 08, 2021:

Of all Hong Kong Dividend Growth stocks, the averages are:

- The average yield of all companies in the Directory is 5.25% . Last week average yield was 5.38%

- Of all these stocks the average 5-year-average-dividend-growth is 21.93%

- 1-year-average Dividend growth is 14.26%

- When we do: yield 5.31% x growth 21.93% => 10%-Yield-on-Cost will be in 5 years.

- Average Price-to-Earnings ratio (P/E) is: 12.33, last week PE was over 12.23

- Average Earnings per Share (EPS) is: 1.153

Great links you can not miss out on:

- The latest top 10 Highest yield Dividend Growth stocks

- Upcoming Ex-Dividend dates this week

- Watch some Beautiful Dividend Charts

- How to Become a Champion Member in 5 minutes?

If you have a question, recommendation, or bright idea, be sure to let me know.

Just reply to this email.

|

Sign up for freeand get immediate access to |

|

|

YES, FOR FREE We promise to only send you amazing helpful emails! |