200613 Update Hong Kong Dividend Growth stocks

This is the newsletter you get if you sign up (FREE) below to see the stock screeners favorite this week. You also get to immediately download the 25 highest yield Dividend Growth Stocks.

If you need a deeper level and full spectrum of all Dividend Growth Stocks and Blue Chip Stocks of Hong Kong including the stock screener to optimize your (or your clients portfolio), it is recommend to become a Champion member.

In this update:

- This weeks Top 5

- Dividend announcements June 8-12

- New Dividend Challenger

- If you missed it last week: New added metric in the Directory of all Hong Kong Dividend Growth stocks:

- Blue Chip Value Insights

- HSI compared to January 1

This weeks Top 5

In this weeks top 5 we look at the companies that have the lowest price in the last 52 weeks compared to their highest price in the last 52 weeks. The calculation is Price now/Price 52 week high.

In the Directory of All Hong Kong Dividend Growth stocks you will find it in the column Price to 52 week high

It tells us what % the current price is to the highest price in 52 weeks. You might have to look deeper, what caused the prices to drop. This can a good starting point into finding new undervalued pearls for your Dividend Growth portfolio.

The top 5 :

| Tickers | Name | Price to 52 week high % |

| HKG:0222 | Min Xin Holding | -54.42% |

| HKG:0752 | PICO FAR EAST | -53.68% |

| HKG:2356 | Dah Sing Bank | -52.81% |

| HKG:0257 | China Everbright International Ltd. | -46.15% |

| HKG:0306 | KWOON CHUNG | -45.78% |

Dividend Growth announcements in the past week

Cross-Harbour (0032.HK) HK$ 0.06 Interim 0% growth or cut

New Dividend Challenger:

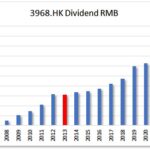

Dickson Concepts (0113.HK)

a Hong Kong Blue Chip with 5 consecutive years of dividend increases.

If you missed it last week : New added metric in the Directory of all Hong Kong Dividend Growth stocks:

Price to Book ratio. (P/B Ratio) This is the price of the stock divided by the book value. This metric helps to find stocks that are undervalued of overvalued.

Another metric to look at in the P/E value (Price to Earnings) depending on your flavor anything higher than 15-20 is overvaluing a stock.

P/E ratio’s are also mentioned in the list of 25 Hong Kong Dividend growth stocks with the highest yield. (See the update below.)

HSI compared to January 1, is now at a mild -13%

Blue Chip Insights

-Blue Chip stocks are down average -16%

-Biggest loser: China Unicom 0762.HK) -41% since January 1

-Biggest winner: 1177.HK Sino Biopharm +26%

To become a Contender or Champion member and have access to

the Complete Directory and website ,

GO HERE

Wishing you a fruitful weekend,

Petra @ Hong Kong Dividend Stocks

|

Sign up for freeand get immediate access to |

|

|

YES, FOR FREE We promise to only send you amazing helpful emails! |