Hong Kong Dividend Growth Stocks

DATA FOR BUILDING DIVIDEND INCOME – AND VALUE PORTFOLIOS

Start

1-What is Dividend Growth Investing?

What is Dividend Growth Investing? Dividend Growth Investing is a buy and hold investment strategy…

2- What are Dividend Challengers, Contenders and Champions?

What are Dividend Challengers, Contenders and Champions? And how does it work? David Fish came…

3- How to pick the best Dividend Stocks?

How to pick the best Dividend Stocks, a not so complicated guide. In the…

4-What is Hong Kong Dividend Stock Screener?

What is the Hong Kong Dividend Stock Screener, what does it do? All stocks in…

Most popular

Upcoming Ex-Dividend dates in Hong Kong

Upcoming Ex-Dividend dates in Hong Kong for Dividend Growth stocks. The following Dividend Growth Companies…

Top 10 High yield Dividend Stocks

You found it: The Top 10 High yield Dividend Stocks. These are companies that have…

Upcoming Ex-Dividend Dates for Hong Kong Blue Chip Companies

Upcoming Ex-Dividend Dates for Hong Kong Blue Chip Companies Below is the list of…

Editorial

The facts on Chinese zodiac and the Hang Seng Index

Stock picking made so easy.

10 reasons why Hong Kong dividend stocks are awesome

5 Reasons Hong Kong blue chip stocks stand out

The 2024 Dogs of the Hang Seng

Dogs of the Hang Seng mid-year results

The top 10 Blue Chip stocks that are leading the bull-run

Market Sentiment vs. Reality: Why Data Should Guide Your Stock Investments

Why Dividend Growth Stocks Are a Smart Play in This Bull Rally

top 10 highest yield

HKG:0008 PCCW Ltd.

HKG:0008 PCCW Ltd. Interim 2024, negative EPS, even negative in equity. This causes a lot…

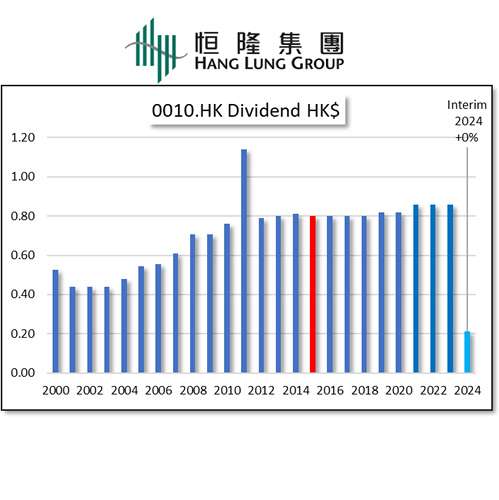

HKG:0010 Hang Lung Group

HKG:0010 Hang Lung Group Hang Lung Group Ltd (0010.HK) is an investment holding company principally…

HKG:0034 Kowloon Development Co. Ltd.

HKG:0034 Kowloon Development Co. Ltd. The Group is mainly engaged in investment holding, property development,…

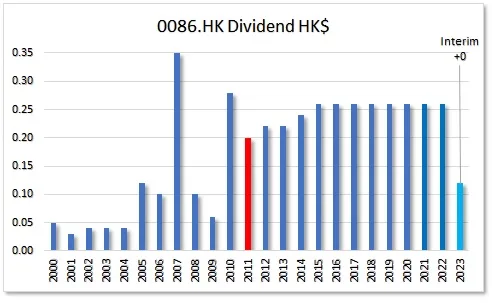

HKG:0086 Sun Hung Kai & Co. Ltd.

HKG:0086 Sun Hung Kai & Co. Ltd. Sun Hung Kai (0086.HK) had a bumpy dividend…

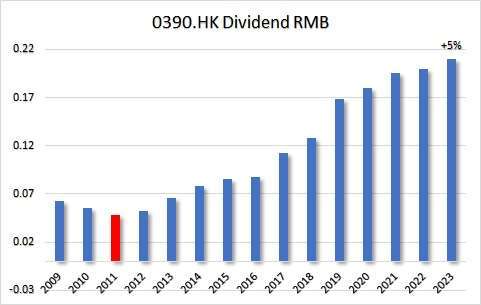

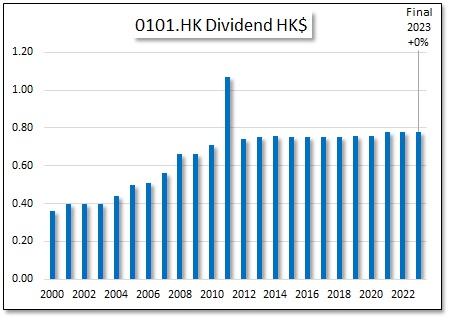

HKG:0101 Hang Lung Properties

HKG:0101 Hang Lung Properties Hang Lung Properties Ltd (0101.HK) is an investment holding company mainly…

HKG:3360 FE Horizon

HKG:3360 FE Horizon This is a company that helps people with money-related things. They have…

HKG:1883 CITIC TELECOM

HKG:1883 CITIC TELECOM The Group is dedicated to providing a wide range of telecommunications services,…

HKG:1373 IH RETAIL

HKG:1373 IH RETAIL is an investment holding company mainly engaged in the retailing of housewares…

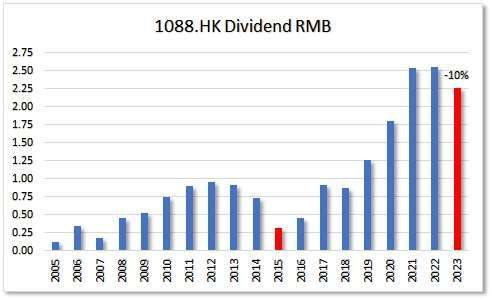

HKG:1088 China Shenhua

HKG:1088 China Shenhua China Shenhua is a globally-leading integrated coal-based energy company, mainly engaging in…

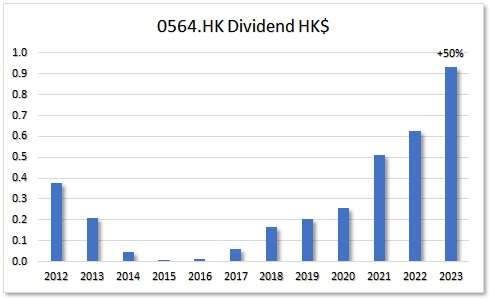

HKG:0564 ZMJ

HKG:0564 ZMJ This company has become an important global coal mine technology and equipment supplier,…