4-What is Hong Kong Dividend Stock Screener?

What is the Hong Kong Dividend Stock Screener, what does it do?

All stocks in The Directory have 1 thing in common, all have not lowered their dividends for 5 years or more.

If you want to find investments that can generate income and therefor are presumed to have less volatility in your clients’ portfolio, we’ve already done the time-consuming work for you.

All listings on the HSI have been checked and are being checked daily. The HKDS Directory we capture all companies that meet the specific criteria of having a dividend increase streak of 5 years or more.

Great, and how do you see quickly what can be interesting stocks without getting lost in all the metrics, filters and other chit-chat?

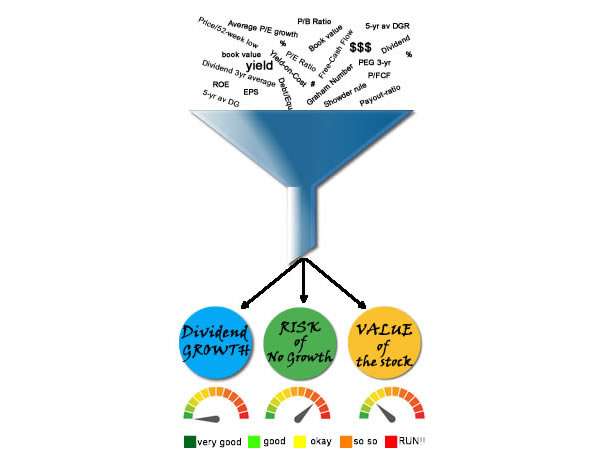

Glad you asked, because this is exactly why the Hong Kong Dividend Stock Screener came to life. A tool to help you see what stocks The Directory are worth your time to take a deeper look at. The screener is based on 3 principles.

Growth, Risk & Value.

How does the HKDS Fast Stock Screener look like in the Directory?

There are 3 principle questions,

- How is the Growth of dividends? On a scale of 1-100. 1 being hardly any growth, 100 being a stock with high growth. (See the blue header)

- How is the Risk of dividend cuts? On a scale of 1-100. 1 being high risk forecast, 100 being it looks sunny and safe. (See the green header)

- Is this stock at a good Value now? On a scale of 1-100 is the price under- or overvalued at this time? 1 being probably overvalued, 100 being this might be a good deal. (See the orange header)

For the results: The cell colors and numbers are orchestrated by conditional formatting.

In this example you see that HKG:0008 PCCW scores very well on the Growth indicators but is at high Risk of dividend decreasing measures.

The colors indicate the following:

As you see, easy on the eyes.

Which bench marks are being used?

Now, this is a little more complicated but as a general sense you can look at all these metrics and build your own stock screener.

Based on the figures of the financial reports of at least 5 years.

That is it. It took longer to build it all than to explain it, luckily.

The next step, is investigation what we do not know yet. This might start with answering the following questions:

- Do you fully understand what the company is doing?

- How does the company make money?

- Is that going to continue? Or do you see the business becoming obsolete?

- How does Covid effect the company? Or any other crisis? Airlines and hotels might not be in good shape to bring you dividend income. Medicine and medical equipment might rise.

- What are the interim reports, saying?

- Are there investments done in other companies that might bring the company down?

- How did this company react to the crisis in 2001 or 2008?

- Is there any other news that you do not know?

As you see, the numbers, benchmarks and metrics are the start of filtering out fast what is suitable for you in your investment strategy.

Subscribe to the newsletter and receive this week’s 25 high yield Dividend Growth companies immediately in your email for FREE

Or become a Member and get to know all Dividend Growth Stocks on the Hong Kong stock market.

|

Start here:Your FREE Dividend Growth and Blue Chip kit |

|

|

YES, FOR FREE No spam, promise! |