3- How to pick the best Dividend Stocks?

How to pick the best Dividend Stocks, a not so complicated guide.

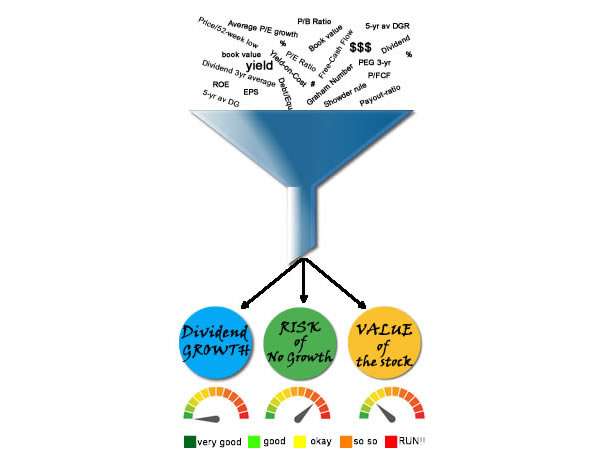

In the quest of finding the best dividend growth stocks, it is easy to get tangled in many details to look into. In this post you can narrow your choices down after asking the 3 most important questions.

Not: if you are not sure what dividend growth investing is, read this first.

These 3 answers prepare you to go deep diving into the company of your selection. The aim here is to filter out the noise that comes along with finding stocks right for your portfolio. This way you will safe your precious time.

That said, let’s get all on the same page of Dividend Growth Investing rules:

Rule number 1: Do not lose money. Clear.

Now, in order to do so dividend growth investing has 2 clear goals,

- Create a growing cash flow generated from dividends. So you receive more income each year. (Like getting a raise.)

- Have the invested money grow in value. So the stocks you bought increase in value year after year.

For the second point, the general idea of dividend growth investing, is to buy and to hold. Just take care that you do not pay too much for overpriced stocks or see a stock collapse and with that the prediction of receiving more dividend. Do not lose money, remember?

Also keep in mind there are a ton of other questions you should want answered before investing in a company. The follow in 3 are most important to make a draft selection of your future assets.

Of all dividend growth stocks you have to your availability:

Q1: How much CASH FLOW will I get now and in the future?

This goes to how much yield and growth you can expect.

Q2: How certain is it I get (more) dividend?

This one is for SAFETY of your investment. Keep in mind, high yield can also be the indicator of trouble in the company.

Q3: Will stock grow in VALUE?

This question goes to the price you pay and the value the stock will gain over time.

Yes, how to pick the best Dividend Stocks, all boils down to these 3 simple questions.

The weight of those answers are a personal flavor. Some can live with low yield, but really do crave that certainty. Some might have emotional issues knowing they overpay for their assets. And others would like a more risky stock to fatten up their portfolio. You have to get this right for your self before you do any other research.

It is also about how you perceive risk in relation to reward. High yield, most of the time does not go hand in hand with safety. Nor does high yield get along with growing value.

With this in mind it becomes an art to find that sweet spot where steady growth in cash flow can be a result of increasing value, which can be a safe way to invest.

The answers should lead to a comprehensive set of metrics to gain insight in each question in order to get you the best Dividend Growth Stocks.

|

Start here:Your FREE Dividend Growth and Blue Chip kit |

|

|

YES, FOR FREE No spam, promise! |