211218 Update Hong Kong Dividend Growth Stocks

This is the newsletter you get if you sign up (FREE) below to see the stock screeners favorite this week. You also get to immediately download the 25 highest yield Dividend Growth Stocks.

If you need a deeper level and full spectrum of all Dividend Growth Stocks and Blue Chip Stocks of Hong Kong including the stock screener to optimize your (or your clients portfolio), it is recommend to become a Champion member.

A quick reminder:

All Hong Kong Dividend Growth stocks that are eligible to be an entry in the Directory for Champion Members they must have:

- 5 years or more of dividend increases

- 5 yr dividend growth rate of 0.001 or higher.

Reading time of this email: 2 minutes.

– What happened last week? Very Special Dividend

– NEW Blue Chip Company, this might be good

– The stock screeners favorite this week

– The 25 highest yield dividend growth stocks, what stands out?

– Hong Kong Dividend Growth Stocks averages on December 18, 2021:

– Great links you can not miss out on

– What happened last week?

SITC HKG:1308 came with a Special Dividend of HK$0.80. That on top of a interim dividend raise of 22% in August. Final Dividend over the year ending 31 Dec 2021 must be exhilarating!

Talking about the Hong Kong Blue Chip Companies.

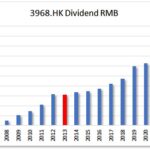

Enn Energy HKG:2688 became a Blue Chip. If you look at their Dividend chart, you see something peculiar. It seems over 2015 there was a cut, hence the red. Because of that this company is qualified as a Dividend Challenger.

Question: was this really a cut or was the year 2014 a exceptionally generous dividend year that makes the next year just look bad? Let me know what you think, because I tend to look at this stock as being a Dividend Contender. see that chart here

With Enn Energy becoming a Blue Chip there are more stocks that hold these 2 flags: Blue Chip and Dividend growth. On the Champion Members page there is an updated file with all these super stars. Coming week I want to look into the details to see if those companies (Dividend Growth and Blue Chip) are indeed good choices for long term investors.

Next week

Nearing Christmas and New year, coming week we can expect a dividend announcement of Tencent HKG:0700. Rare, because they don’t do interim or special dividends.

And IH retial HKG:1373 is up for their interim results ending October 30, 2021. Last interim dividend was HK$ 0.09, so lets see how they decide.

The Stock Screener likes Sinopharm HKG:1099

- Yield 4.9%

- EPS 2.83

- P/E 5.92

- Interim growth in EPS (YoY) 16%

- Payout Ratio 30%

- 5-yr average Dividend Growth 11%

How to use the stock screener to make an impact on your portfolio?

The Stock Screener is an essential part of the Directory of all Hong Kong Dividend Growth stocks.

Essentially this is what we are looking for:

Stocks that have

-as much as possible dividend growth in the future

-against the lowest possible risk

-with the highest rise in Value of our invested capital.

-The 25 highest yield dividend growth stocks and the Directory for Champion members, what stands out?

There are 2 companies that yield over 40%. That has not happened before. Both are in the property sector. Just draw your conclusions there.

My suggestion, if you want to look only to Yield, P/E and EPS check out HKG:0939 China Construction Bank Cooperation

Hong Kong Dividend Growth Stocks averages on December 18, 2021:

Of all Hong Kong Dividend Growth stocks, the averages are:

- The average yield of all companies in the Directory is 6% . Last week average yield was 5.38%

- Of all these stocks the average 5-year-average-dividend-growth is 21.81%

- 1-year-average Dividend growth is 14.05%

- When we do: yield 6% x growth 21.81% => 10%-Yield-on-Cost will be in 4 years.

- Average Price-to-Earnings ratio (P/E) is: 10, last week PE was over 12.23

- Average Earnings per Share (EPS) is: 1.27

Great links you can not miss out on:

- The latest top 10 Highest yield Dividend Growth stocks

- Upcoming Ex-Dividend dates this week

- Watch some Beautiful Dividend Charts

- How to Become a Champion Member in 5 minutes?

If you have a question, recommendation, or bright idea, be sure to let me know.

Just reply to this email.

Wishing you a happy day,

Petra @ Hong Kong Dividend Stocks

Twitter and Facebook.

Click and keep in touch easily with HKDS!

|

Sign up for freeand get immediate access to |

|

|

YES, FOR FREE We promise to only send you amazing helpful emails! |