News

Latest News

Features and Events

Express News

Culture News

Editor Picks

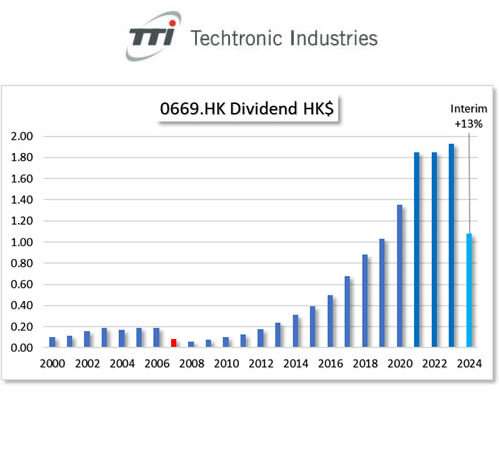

HKG:0669 TECHTRONIC IND

HKG:0669 TECHTRONIC IND 0

HKG:2357 Avi China

HKG:2357 Avi China 0

HKG:2669 China Overseas Property Holdings Ltd.

HKG:2669 China Overseas Property Holdings Ltd. China Overseas Property Holdings Limited (2669.HK) is an investment holding company principally engaged in the provision of property management services. This enterprice operates its business through two segments. The Property Management Services segment is engaged in the provision of property management services to mid- to high-end residential communities, commercial properties, government properties and construction sites, including security, repairs and maintenance, cleaning and garden landscape maintenance service. The Value-added Services segment is engaged in the provision of engineering services, community leasing, sales and other services.

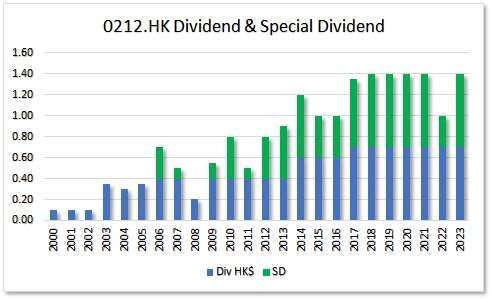

HKG:0212 NanYang Holding

HKG:0212 NanYang Holding The Group is engaged in property investment and investment holding and trading. NanYang Holding (HK0212.HK) A dividend Contender. Although the dividend growth is not on a year on year base, the has not been a dividend decrease since 2008.

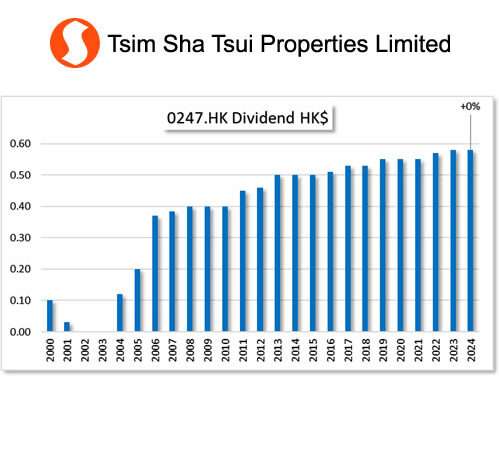

HKG:0247 TST PROPERTIES

HKG:0247 TST PROPERTIES It is a characteristic of a contender. The dividend growth is slow and steady.

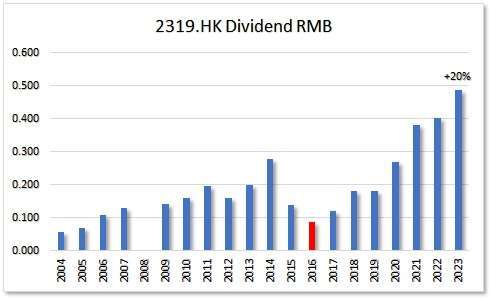

HKG:2319 Meng Niu

HKG:2319 Meng Niu Mengniu is a leader in China’s dairy industry. 2023 Came with a 20% dividend raise. This 7 year Dividend Challenger is also a Hong Kong Blue Chip. Let’s look at more numbers on dividend growth:

HKG:1299 AIA Group Ltd.

HKG:1299 AIA Group Ltd. What a picture, this dividend chart. Textbook Dividend Growth company. Although the yield is low with this price, the growth rate is exponential. Dividend payout ratio is a healthy 30%. There might be a bit overvalue in the price if you look at the P/E, but this is a Hong Kong Blue Chip company. They come for a price.

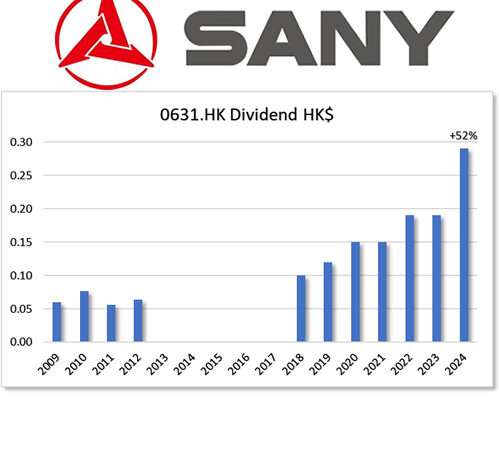

HKG:0631 Sany Int’l

HKG:0631 Sany Int’l This company is mainly engaged in manufacturing and selling mining equipment, logistics equipment, robotic and smart mined products and spare parts and the provision of related services in Mainland China.

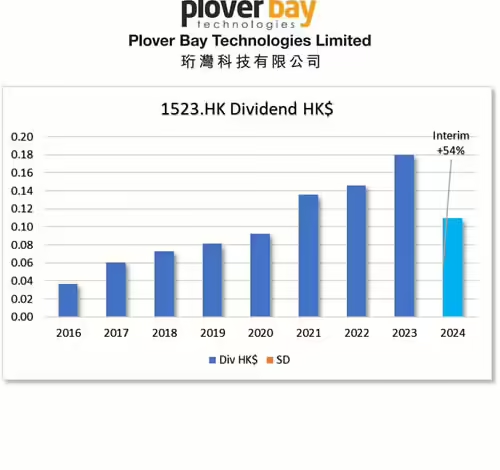

HKG:1523 Ploverbay

HKG:1523 Ploverbay This particular Dividend Challenger shows strong potential. If the trend of increasing dividends continues as it has been, excluding the Special Dividend of 2023, it is projected to reach the 10% yield to cost milestone by 2025.

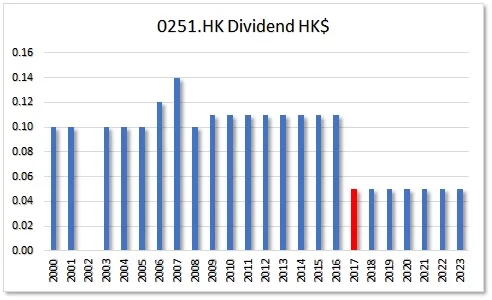

HKG:0251 Sea Holdings

HKG:0251 Sea Holdings The activities of the group were property investment, property development, hotel operation and financial investment in Hong Kong and the United Kingdom.