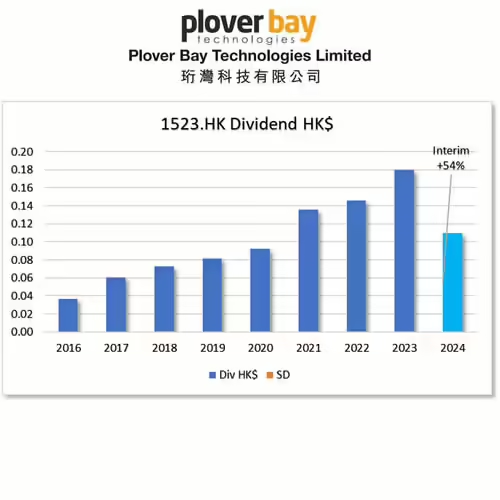

HKG:1523 Ploverbay

HKG:1523 Ploverbay operates in the field of IT hardware. This particular Dividend Challenger shows strong potential. Interim dividend of year ending 12/2024 rise by 54%. As did EPS.

HKG:1523 Ploverbay

Last update: 29-Jun-24

Quick overview:

-

- Yield: 4.86%

(See here Top 10 highest yield)

-

- Lot: 8000

- Price/Earnings ratio : 18.50 (Ideal <20 )

- Earnings per share : 0.200 (Ideal >0.001)

- Price as per 29-Jun-24 : HK$3.70

- Ex-Dividend Date coming up: N/A

See here all upcoming Ex-Dividend dates

Log in, to see this page |

|

Start here:Your FREE Dividend Growth and Blue Chip kit |

|

|

YES, FOR FREE No spam, promise! |