220320 Update Hong Kong Dividend Growth Stocks

This is the newsletter you get if you sign up (FREE) below to see the stock screeners favorite this week. You also get to immediately download the 25 highest yield Dividend Growth Stocks.

If you need a deeper level and full spectrum of all Dividend Growth Stocks and Blue Chip Stocks of Hong Kong including the stock screener to optimize your (or your clients portfolio), it is recommend to become a Champion member.

What is this mail about; We look at the data of only Hong Kong Blue Chip companies and all the Hong Kong Dividend Growth Companies.

What are Dividend Growth Stocks?? They are HK listed companies that have

- 5 years or more of dividend increases

- 5 yr dividend growth rate of 0.001 or higher.

Based on a lot of data we look for good opportunities for Dividend Income creation and Value Investing . (Dividend Growth, Risk of not getting any Dividends and Value for Price)

Warning reading time of this email: 2 minutes. But you will come out smarter!

- This weeks news, new challengers

- Stock Screener alert of the week!

- The 25 highest yield dividend growth stocks.

- Hong Kong Dividend Growth Stocks averages on March 18, 2022:

- Great links you can not miss out on

If you are planning on investing in yourself and in building the best possible portfolio that generates dividend income and growth in total value, the Champion Membership can get you on your way. Data, for Discovering hidden treasures and making calculated Decisions.

If you have special request for data sets. Just let me know, ASAP. Just send me an email. It would be fun to make customized files.

– This weeks results.

2 Companies announcing their interim results. All Ex-Dividend dates are noted hereThese 2 Blue Chip Companies became Dividend Growth stocks. With 5 consecutive years of dividend raises, they are now added to the Directory of all Hong Kong Dividend Growth Stocks.

These 2 got added:

- HKG:0388 HKEx . Does this company need any introduction?

- HKG:0762 China Unicom . One of the largest telecommunication companies in China. Maybe even in the world..

Why is this good?

Blue Chip Companies tend to be better with dealing with market sentiment. There is a lot of faith from investors in these stocks when turbulence is hitting. And they tend to rise in value over time. That makes Blue Chips a buy and hold investment.

Imagine also receiving more and more cash flow (Dividends) every year, by just holding the stocks. That’s 2 birds with one stone.

If a company has those 2 advantages it should get our attention as these companies can become a building block for a strong portfolio.

Champion Members, there is a file that reveals all Dividend Growth stocks that are also Blue Chips stocks. If you do not know where to start researching your next investment, this is a good place.

– What did the Stock Screener pick this week?

The Directory of all Hong Dividend Growth stocks has a ‘mechanism’ in place that spots which stocks look good on 3 segments:

- Dividend Growth,

- Risk of Dividend getting cut or

- Value for money

This week [sorry, this part is for newsletter readers only] has a close to perfect score according to the stock screener.

- Yield 8%

- P/E : 4

- EPS 0.75

- Payout Ratio 38%

- Interim results look good too. Interim dividends went up 25%

Keep in mind, this is NOT investment advice, just an observation of numbers of a particular company. You can use this for deeper research.

-The 25 highest yield dividend growth stocks

are updated. that .xls file you will find on the free members page and the Champion members page.

In case you missed it last time. This week P/B Ratio is the extra number in the 25 highest yield Dividend Growth stock list.

Price-to-Book-ratio tells you if the value of the company is according the price in the market of the stock.

For this you need to know the book value. Book value is (All assets – All liabilities) / outstanding shares.

If the company tumbles and has to sell all assets and solve liabilities the shareholders would get this amount per share.

Let’s do an example.

- Assets 100.000

- Liabilities 43.000

- Outstanding shares: 10.000

- Price per share: HK$ 5.00

100.000-43.000= 57.000

57.000/10.000 = HK$ 5.70 Hooray!! This is the book value per share.

Now, the Value of 1 share is HK$ 5.70 and, low and behold, the market price of 1 share is HK$5.00. Price is lower than value. Yahtzee!!

Price/book ratio will go like this:

5.00/5.70= 0.88

Conclusion: P/B ratios smaller than 1.0 might indicate undervalued stock.

So what should be a acceptable P/B ratio? Value investors see any number smaller than 3 as a good ratio. Investopedia has a good post about this.

Keep in mind: for determining if a stock is of good value there are more factors to look into. The Value part of the Stock Screener looks at 9 metrics to get good insight on Value vs Price.

Now check out the updated 25 highest yield dividend growth stocks and spot some of the dividend growth companies that might be undervalued. (sign up ,free, if you haven’t yet. You get direct access this file.)

Hong Kong Dividend Growth Stocks averages on March 18, 2022,

Of all Hong Kong Dividend Growth stocks:

- The average yield of all companies in the Directory is almost 7% .

- Of all these stocks the average 5-year-average-dividend-growth is 23%

- 1-year-average Dividend growth is 15%

- When we do: yield 6.8% x growth 23% => 10%-Yield-on-Cost will be in 4 years.

- Average Price-to-Earnings ratio (P/E) is: 10,

- Average Earnings per Share (EPS) is: 2

Great links you can not miss out on:

- The latest top 10 Highest yield Dividend Growth stocks

- Download 25-Highest-yield Dividend Growth Stocks

- Upcoming Ex-Dividend dates this week

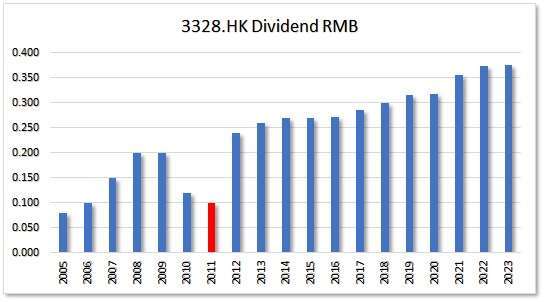

- Watch some Beautiful Dividend Charts

- How to Become a Champion Member

If you have a question, recommendation, or bright idea, be sure to let me know. Just reply to this email.

Wishing you a happy day,

Petra @ Hong Kong Dividend Stocks

One more thing: to keep track on all things Hong Kong Dividend and Blue Chip stocks, it is highly recommended to follow HKDS at

Click and keep in touch easily with HKDS!

|

Sign up for freeand get immediate access to |

|

|

YES, FOR FREE We promise to only send you amazing helpful emails! |