220130 Update Hong Kong Dividend Growth Stocks

This is the newsletter you get if you sign up (FREE) below to see the stock screeners favorite this week. You also get to immediately download the 25 highest yield Dividend Growth Stocks.

If you need a deeper level and full spectrum of all Dividend Growth Stocks and Blue Chip Stocks of Hong Kong including the stock screener to optimize your (or your clients portfolio), it is recommend to become a Champion member.

If you are celebrating Chinese New Year this weekend, of coming week. I wish you a wonderful year of the Tiger. May good fortune, excellent health and awesome joy find their way to your life!

What is this mail about; We look at the data of Blue Chip companies and all the Hong Kong listed companies that have

- 5 years or more of dividend increases

- 5 yr dividend growth rate of 0.001 or higher.

Based on a lot of data we look for good opportunities for Dividend Income creation and Value Investing . (Dividend Growth, Risk of not getting any Dividends and Value for Price)

Warning reading time of this email: 6 minutes. But you will come out smarter!

– This weeks results.

– Stock Screener alert of the week!

– The 25 highest yield dividend growth stocks.

– Dividend Growth: Top 3 up, top 3 down

– Blue Chips Top 3 up since January 1

– Hong Kong Dividend Growth Stocks averages on January 28, 2022:

– Great links you can not miss out on

If you are planning on investing in yourself and in building the best possible portfolio that generates dividend income and growth in total value, the Champion Membership can get you on your way. Data, for Discovering hidden treasures and making calculated Decisions.

If you have special request for data sets. Just let me know, ASAP. Just send me an email. It would be fun to make customized files.

– This weeks results.

Vinda International HKG:3331 gave a 6% Dividend raise.

Over to the property sector;

HKG:0010 Hang Lung Group got their results in. Dividends went up by almost 5%.

HKG:0101 Hang Lung Property got up 2% with their dividends. This is also a Blue Chip.

– What did the Stock Screener pick this week?

Content for subscribers only. Sign up below and see what the stock screener picks next newsletter.

-The 25 highest yield dividend growth stocks

are updated. that .xls file you will find on the free members page and the Champion members page. This week the extra metric is Dividend Coverage Ratio.

This number tell us how many times dividends can be paid from net income. So is the company making enough money to keep on paying their shareholders. This metric falls under the RISK part of the Stock Screener.

How to calculate this Dividend Coverage Ratio?

Dividend Coverage Ratio = Net income / Dividend declared

If the company has a net income of 20.000 and a declared dividend of 5.000 we get a ratio of 4. Which is very good.

Ideal is a ratio of 2 or higher. less than 1 could be really trick. in can indicate there is not enough income to pay higher dividends and either the company pays from her reserves or decides to the take the sword and cuts down on dividends..

This might sound a bit like this metric: Dividend Payout Ratio. Also a gem if we want to see the Risk of not getting any dividends.

here we get answer to the question what is the percentage of Net Income that gets into dividends? Ideally anything below 50% is great.

Simply said, because we want to see the company grow. Net Income is necessary for new investments that lead to higher payments to the shareholders.

Pardonnez my uber-simplification.

How to calculate Dividend Payout Ratio?

Dividend Payout Ratio = Dividends Paid / Net Income

If we use above example: 5.000 / 20.000 comes to 25% . Good score!

If you have any questions, just send an email and let me know how I can help.

Talking more about this Dividend Payout ratio.

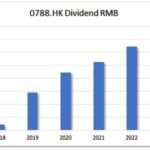

The Champion Membership includes Dividend History Reports of all companies that have their Dividend Growth policy in place for 5 years or longer.

In these reports we look in more detail to the yearly dividend payouts, the growth per year and how many years it would take to get to 10% Yield on Costs.

What is this report telling you?

We want to know how the dividend growth is going to effect yield. Low yield high yearly growth is a good thing, if RISK is acceptable. High yield, low growth is going to catch up one day. Your income should increase if only to counter inflation.

Dividend Growth Stocks: Top 3 up, top 3 down

Out of all the Dividend Growth stocks these 3 gained in price the most over the first week of January.

Vinda International HKG:3331 +5% Makes sense they came home with good grades this earlier week

Vstecs HKG0856 +5% (it Hardware)

Citic Telecom HKG:1883 +4.8% (Telecom)

Not that spectacular this week.

Now we go the the Stocks that lost the most in price. There might be some good bargains here:

HKG:3380 Logan Group . -28% (Property..)

HKG:1813 KWG Group -20% (Property..)

HKG:1918 Sunac -17% (Property…)

Property Developers are still taking it hard.

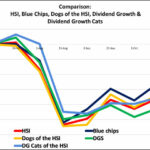

Blue Chips Top 3 up,

Since January 1 how are the prices of the Blue Chips?

Top 3 companies that went up price-wise are

HKG:0688 China Overseas +24% (Property Development) Positive sales numbers. (Yes this is a Dividend Growth company too!!!)

HKG:0960 LongFor Group +23% (Property Development)

HKG:1928 Sands +18% (Gambling)

Hong Kong Dividend Growth Stocks averages on January 28, 2022,

Of all Hong Kong Dividend Growth stocks:

- The average yield of all companies in the Directory is 6.11% . Last week average yield was 5.95%

- Of all these stocks the average 5-year-average-dividend-growth is 21.88%

- 1-year-average Dividend growth is 13%

- When we do: yield 5.95% x growth 21.93% => 10%-Yield-on-Cost will be in 5 years.

- Average Price-to-Earnings ratio (P/E) is: 10.09, last week PE was over 10.56

- Average Earnings per Share (EPS) is: 1.988

Great links you can not miss out on:

- The latest top 10 Highest yield Dividend Growth stocks

- Download 25-Highest-yield Dividend Growth Stocks Sign up below to download

- Upcoming Ex-Dividend dates this week Ha, only have 1 Ex-dividend coming up. We have to wait till the end results of 2021 come in.

- Watch some Beautiful Dividend Charts

- How to Become a Champion Member

- Meanwhile on Twitter

If you have a question, recommendation, or bright idea, be sure to let me know.

Just reply to this email.

Wishing you a happy day,

Petra @ Hong Kong Dividend Stocks

Twitter and Facebook.

Click and keep in touch easily with HKDS!

|

Start here:Your FREE Dividend Growth and Blue Chip kit |

|

|

YES, FOR FREE No spam, promise! |