News

Latest News

Features and Events

Express News

Culture News

Editor Picks

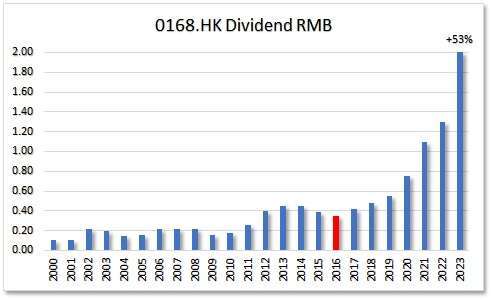

HKG:0168 TsingTao Brew

HKG:0168 TsingTao Brew Beer, the most famous beer in China probably. Dividend 2022 also came with a special dividend of RMB 0.50. (not on the chart ) EPS growth for 5 years in a row. Beer seems covid proof if we look at the results of this company.

HKG:0762 China Unicom

HKG:0762 China Unicom This is a weird Dividend pattern. The Growth strategy does not seem applied, more like a random raises. The other news is, that this Company is also a Hong Kong Blue Chip. And then, 27% Dividend growth over 2022.

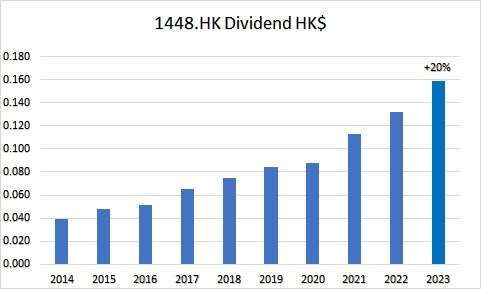

HKG:1448 FuShouYuan

HKG:1448 FuShouYuan They are in the funeral business. Delightful payout patio. Yield could be better. The market has high hopes for this stock when we look at the P/E and P/B ratios.

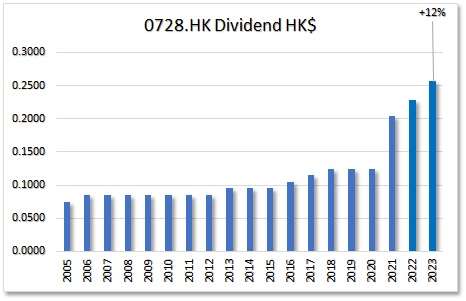

HKG:0728 CHINA TELECOM

HKG:0728 CHINA TELECOM A steady Contender. The average 5 year dividend growth exceeds inflation numbers. Also remarkable, this company never decreased their dividends. Results over 1H 2022 even gave an interim dividend. That did not happen before.

HKG:1083 TOWNGAS CHINA

HKG:1083 TOWNGAS CHINA This company became a dividend contender in 2019.This company never had a dividend decrease so far! Dividend growth ratio is utterly boring. No raise in the last 6 years. Also not over the year 2022. Slow and steady. Let’s look at the numbers now:

HKG:0002 CLP Holdings Ltd.

HKG:0002 CLP Holdings Ltd. This company is all about creating and delivering electricity in places like Hong Kong, Mainland China, India, and Australia. They’re also into investing in power projects across Mainland China, Southeast Asia, and Taiwan. Powering up communities and investing in a brighter energy future.

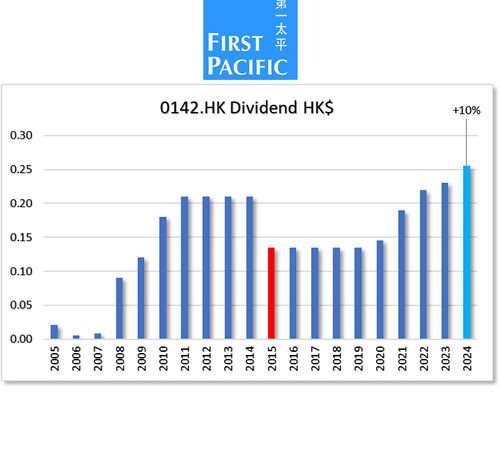

HKG:0142 First Pacific Co. Ltd.

HKG:0142 First Pacific Co. Ltd. The Company’s principal investments are in consumer food products, telecommunications, infrastructure, and natural resources.

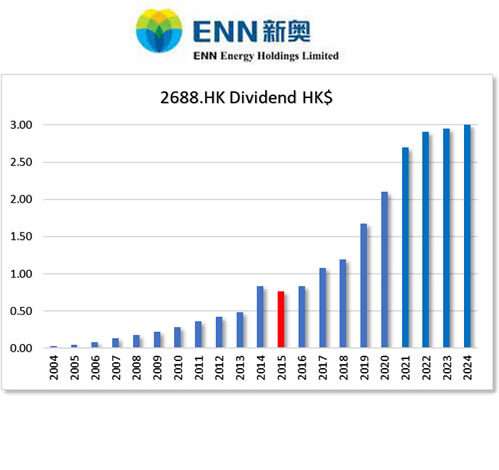

HKG:2688 Enn Energy

HKG:2688 Enn Energy ENN Energy is one of China’s largest clean energy distributors, supplying residential, industrial, and commercial sectors with natural gas and related energy services. It is also expanding its reach into integrated energy solutions like renewable energy and energy storage, aiming to support China’s carbon neutrality goals. Known for its strong revenue and stable dividends, it often attracts interest from dividend growth investors.

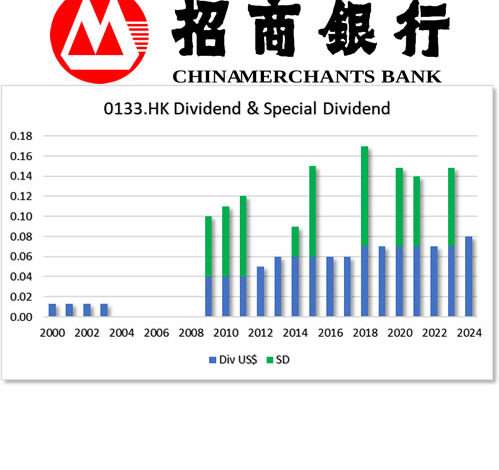

HKG:0133 China Merchants

HKG:0133 China Merchants China Merchants HKG:0133 has a good yield, pay out ration and dividend coverage ratio! EPS growth is up and down.

HKG:0066 MTR CORPORATION

HKG:0066 MTR CORPORATION Look at the beautiful chart. If you are into dividend growth investing, this is what you wish to see. This is a company everybody knows in Hong Kong. MTR Corporation 0066.HK is on the HK exchange since 2000. So far never a dividend decrease.