201212 Update Hong Kong Dividend Growth stocks

This is the newsletter you get if you sign up (FREE) below to see the stock screeners favorite this week. You also get to immediately download the 25 highest yield Dividend Growth Stocks.

If you need a deeper level and full spectrum of all Dividend Growth Stocks and Blue Chip Stocks of Hong Kong including the stock screener to optimize your (or your clients portfolio), it is recommend to become a Champion member.

In this newsletter:

- Look at that magical word Compounding

- Dividend announcements,

- Highlights straight out of the HKDS Directory What’s on sale this weekend?

- Hong Kong Dividend Growth Stocks averages

This week, let’s take a look at that magical word

DIVIDEND COMPOUNDING

5-minute explainer, level: easy | simple | FUN

What does that mean for you, the unbeatable Dividend Growth Investor?

In business you can imagine the compounding force like this:

Replace the Machine by stocks and the rental fee is your dividend. You use that income to buy more quality Dividend Growth stocks to earn more income faster.

Dividend Growth announcements in the past week

PokFuLam (0225.HK) HK$ 0.34 +0% Final Dividend increase

Melbourne Enterprises (0158.HK) HK$ 2.80 +0% Final Dividend increase

Here the list of all upcoming dividend ex-dates for Dividend Growth stocks in Hong Kong.

Highlights straight out of the HKDS Directory

- IH Retail HKG:1373 gained over 14% in value to last week.

- On sale this week: China LongYu HKG:0916 a decline in value of 11% compared to last week.

- Highest yield award goes to: HKG:0106, Landsea Green Properties 13% yield this weekend.

- The stock screener’s favorite of the week is:HKG:1233 Times China . A dividend challenger that never decrease it’s dividend and is now yielding over 9%!

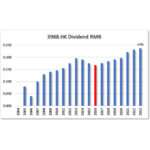

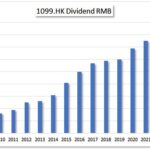

Hong Kong Dividend Growth Stocks averages:

- The average yield of all companies in the Directory is 4.89% .

- Of all these stocks the average 5-year-average-dividend-growth is 21.95%

- When we do: yield 4.89% x growth 21.95% => 10%-Yield-on-Cost will be in 5 years.

- Average Price-to-Earnings ratio (P/E) is: 13.50

|

Sign up for freeand get immediate access to |

|

|

YES, FOR FREE We promise to only send you amazing helpful emails! |