221031 Newsletter

This is the newsletter you get if you sign up (FREE) below to see the stock screeners favorite this week. You also get to immediately download the 25 highest yield Dividend Growth Stocks.

If you need a deeper level and full spectrum of all Dividend Growth Stocks and Blue Chip Stocks of Hong Kong including the stock screener to optimize your (or your clients portfolio), it is recommend to become a Champion member.

Wishing you an interesting week ahead

Reading time of this email: 3 minutes. You will come out wiser.

Let’s look to the adventures of our Dividend Growth stocks listed on the Hong Kong stock exchange.

Reminder: All Dividend Growth stocks are packed in the Directory Data Set #1. This is an easy to understand overview in Excel of all companies that have

- 5 years or more of dividend increases

- 5 yr dividend growth rate of 0.001 or higher.

this way you save a huge amount of time in your research to find the right stocks that are eligible for your cash flow generating portfolio.

For all things Hong Kong Dividend Growth and Blue Chip stocks , it is highly recommended to follow HKDS at

Twitter

Facebook

Click and keep in touch easily with HKDS!

Based on a lot of data we look for good opportunities for Dividend Income creation and Value Investing . (Dividend Growth, Risk of not getting any Dividends and Value for Price)

What do we see this week?

– Last week what stands out? A Dividend Challenger that just could not keep up.

– Champion Members: Something sweet for you in data set #5

– The 25 highest yield dividend growth stocks. About what is not in the list.

– Hong Kong Dividend Growth Stocks averages on October 29, 2022:

– Great links you can not miss out on

If you have special request for data sets. Just let me know, ASAP. Just click ‘reply’. It would be fun to make customized files.

– What stands out?

HKBN HKG:1310 came with their numbers year ending August 31, 2022.

EPS growth 167%

BUT and here it comes, total dividend decreased 21%

How did this happen?

Although all numbers look good or better than previous year, the payout ratio was way above 100%. A company can not keep doing that if they want to invest in growth.

Even with this cut in shareholder payments, the payout ratio is 142%. This company had a dividend increasing streak of 6 years. A beautiful streak as you can see.

Next week this Ex-Challenger will be removed of the list and with that also from the list of 25 highest yield dividend growth stocks.

-Champion Members: In your members area there is a data set that holds all dividend growth stocks that are also Blue Chip companies. (data set 5#)

I highlighted the companies that have a 10% Yield on Costs in 4 years or less!! Based on yield and 5-yr average dividend growth.

What does that mean?

Good question, 10% yield on cost is yield and growth combined. In this case it answers the question, which stock might pay me 10% yield within 4 years or less if I bought them now?

You might be surprised how many companies qualify.

-The 25 highest yield dividend growth stocks

are updated. that .xls file you will find on the free members page (active link in email) and the Champion members page.

In this weeks update of the 25 Dividend Growth Stocks with the highest yield:

- Definitely too good to be true, the highest yield stock brings on paper 70%. Please let me know your reasoning if you think this is attainable.

- Then, say goodbye to HKBN HKG:1310 As mentioned earlier, they are no longer a dividend growth stock.

You can download this free file here (active link in email) and see for your self.

If you do want to hold telecom in your dividend generating portfolio, you might want to take a look at HKG:0728 China Telecom. (This is not on the 25 highest yield list, this week)

- Yield : 7%

- Average 5-yr dividend growth : 16%

- P/E : 9

Let me know what you see and think.

–Hong Kong Dividend Growth Stocks averages on October 29, 2022,

Of all Hong Kong Dividend Growth stocks:

- The average yield of all companies in the Directory is 7% . NOTE: There is one company with 70% yield that is pulling up this average.

- Of all these stocks the average 5-year-average-dividend-growth is 20%.

- 1-year-average Dividend growth is 15%

- When we do: yield 7% x growth 20% => 10%-Yield-on-Cost will be in 4 years.

- Average Price-to-Earnings ratio (P/E) is: 10

Updated links you can not miss out on:

- The latest top 10 Highest Yield Dividend Growth stocks

- Download 25-Highest-yield Dividend Growth Stocks(active link in email)

- Upcoming Ex-Dividend dates this month

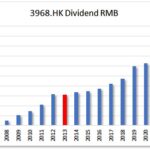

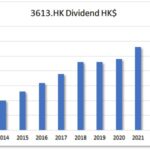

- Watch some Beautiful Dividend Charts

- How to get all dividend growth companies

The Directory is part of the Champion Membership and updated weekly. There is even an easy-to-use stock screener build in, so out of all dividend growth stocks you see in 1 second how they perform on dividend growth, Risk and Value.

Just to make your life easier.

If you have a question, recommendation, or bright idea, be sure to let me know. Just reply to this email.

Wishing you a happy week,

Petra @ Hong Kong Dividend Stocks

One more thing: to keep track on all things Hong Kong Dividend and Blue Chip stocks, it is highly recommended to follow HKDS at

Twitter

Facebook.

Click and keep in touch easily with HKDS!

Kind reminder, this is data, numbers. In no way this is financial advice. (nor legal, nor medical).

|

Sign up for freeand get immediate access to |

|

YES, FOR FREE We promise to only send you amazing helpful emails! |