What is dividend investing? 3 simple steps

What is dividend investing? 3 simple steps

What is dividend? It is a amount you get for owning a stock for a period of time. Not all listed companies pay you dividend so the trick is to find the ones who do.

That is the simple first step.

Step 1- Find stocks of companies that pay dividend.

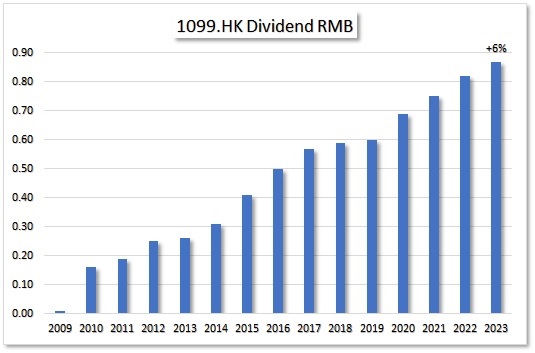

Step 2 – That said, it would be nice if they keep on paying that year after year. Some companies are very consistent is doing so. Every year, you receive the same amount of dividend. Let’s say you get $1 per share per year. Awesome!

Step 3 : It would be even nicer if the amount of dividend would be raised every year of every few years. So not only you get money very year, but you get more money every year by just holding on to your stocks. (First year you get $1.00, second year $1.05, third year $1.10) Brilliant idea of investing you money, right?

Just find the right companies, study their dividend policies and history and buy when the price of the stock is low.

Low price, means better yield. Better yield, means your percentage of return goes up. You rather have your money make 5% a year than 4%.

This said, it boils down to 2 incredibly important questions:

1 Will this company keep on paying year after year more dividend per share?

2 Is the price right to buy?

Good news about this way of investing is that you do not have to worry if market falls. Your eyes should be on the ball in receiving your dividend. Cash-flow triumphs over portfolio value.

So if stock prices drop and everybody around you is getting nervous and seeing their net worth also drop. You remain calm like a Zen-Buddhist. Because you now is the time to buy.

This is a extreme simplified explanation.

Here a few links and resources to grow your knowledge:

This is an all time evergreen

Dave van Knapp’s Dividend Growth Investing Lessons .