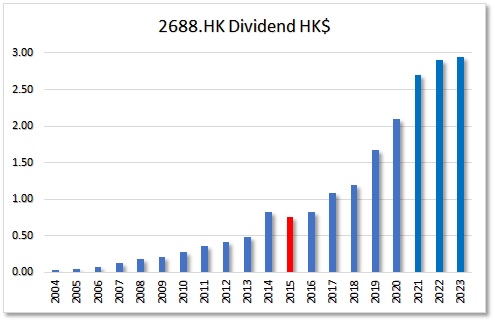

Enn Energy HKG:2688 – Hong Kong Blue Chip stock

Blue Chip Stock Enn Energy HKG:2688 0 Updated: July 1, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 11.17 Price-to-Book ratio : 1.70 preferably <1 although some value investors […]