Beautiful Charts

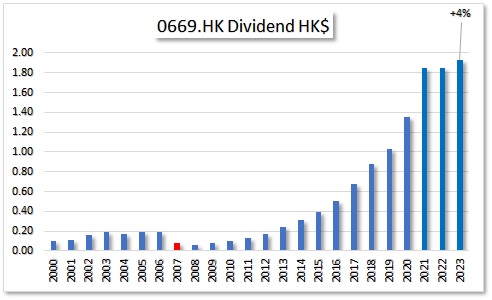

HKG:2669 China Overseas Property Holdings Ltd.

HKG:2669 China Overseas Property Holdings Ltd. China Overseas Property Holdings Limited (2669.HK) is an investment holding company principally engaged in the provision of property management services. This enterprice operates its business through two segments. The Property Management Services segment is engaged in the provision of property management services to mid- to high-end residential communities, commercial properties, government properties and construction sites, including security, repairs and maintenance, cleaning and garden landscape maintenance service. The Value-added Services segment is engaged in the provision of engineering services, community leasing, sales and other services.

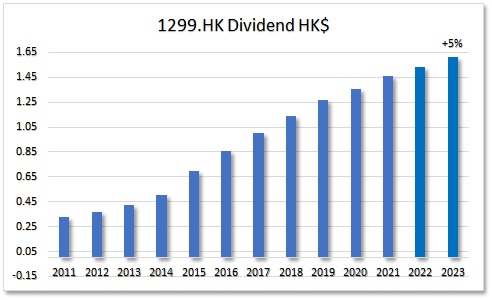

HKG:1299 AIA Group Ltd.

HKG:1299 AIA Group Ltd. What a picture, this dividend chart. Textbook Dividend Growth company. Although the yield is low with this price, the growth rate is exponential. Dividend payout ratio is a healthy 30%. There might be a bit overvalue in the price if you look at the P/E, but this is a Hong Kong Blue Chip company. They come for a price.

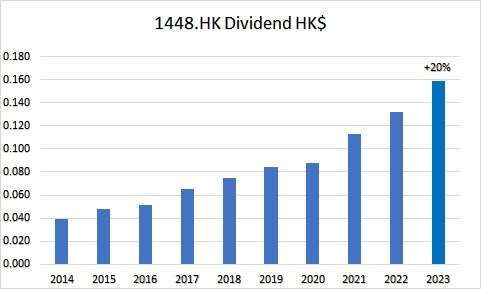

HKG:1448 FuShouYuan

HKG:1448 FuShouYuan They are in the funeral business. Delightful payout patio. Yield could be better. The market has high hopes for this stock when we look at the P/E and P/B ratios.

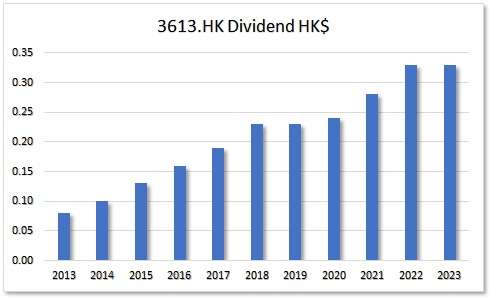

HKG:3613 Tong Ren Tang

HKG:3613 Tong Ren Tang 1H 2022 a special dividend was announced. Final dividend got a raise of 17%. This company is heading to become dividend contender next year. And let’s not forget the beautiful dividend chart. The special dividends is left out conveniently.

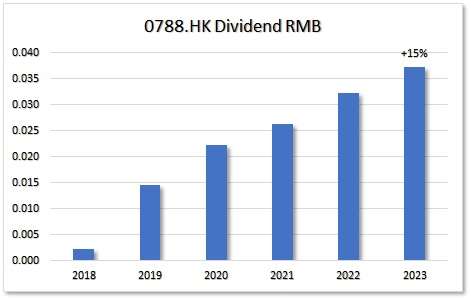

HKG:0788 China Tower

HKG:0788 China Tower The group mainly builds and runs telecommunication towers, rents out space on the towers, provides maintenance and power services, and offers indoor distributed antenna systems and other services. They also work on energy-related business.

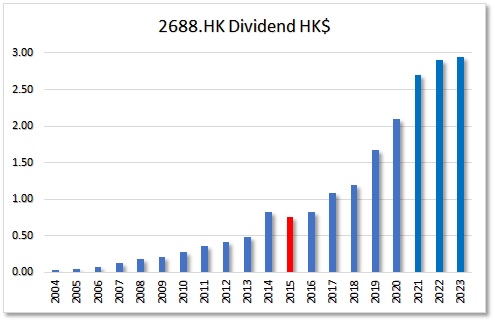

HKG:2688 Enn Energy

HKG:2688 Enn Energy ENN Energy Holdings Limited is an investment holding company principally engaged in gas supply business. The Company is engaged in the sale of piped gas, gas connection, the construction and operation of vehicle gas refueling stations, the wholesale of gas, the sale of other energy and the sale of gas appliances and materials. The Company operates its business in domestic and overseas markets. In 2021 the company became a Blue Chip.

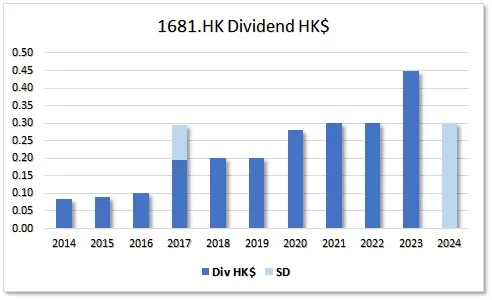

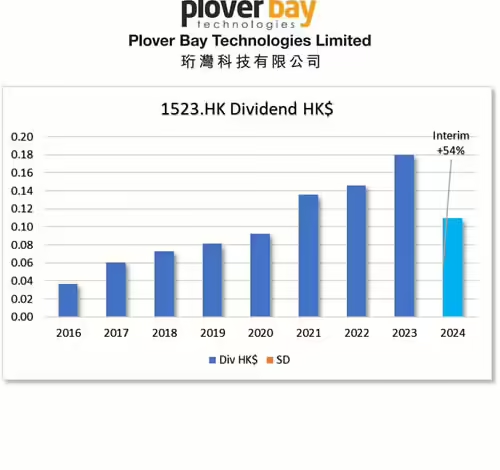

HKG:1523 Ploverbay

HKG:1523 Ploverbay This particular Dividend Challenger shows strong potential. If the trend of increasing dividends continues as it has been, excluding the Special Dividend of 2023, it is projected to reach the 10% yield to cost milestone by 2025.

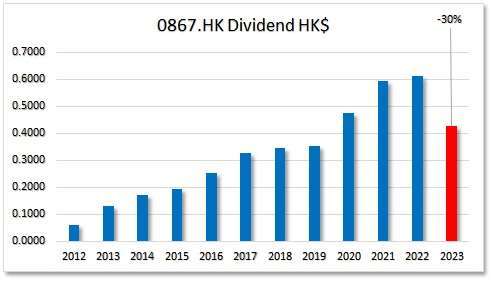

HKG:0867 CMS

HKG:0867 CMS What a beautiful chart! Results of 2022 are okay. Dividends got up 2.5% , Debt/Equity remained stable. This looks promising in terms of higher proceeds of holding this stock. (Average 5-yr Dividend Growth is almost 15%)

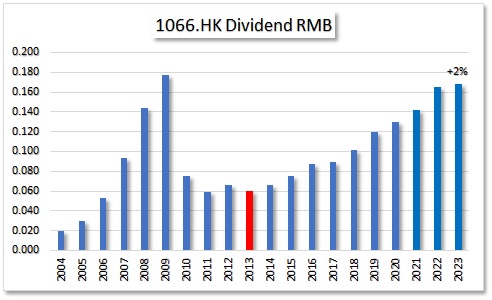

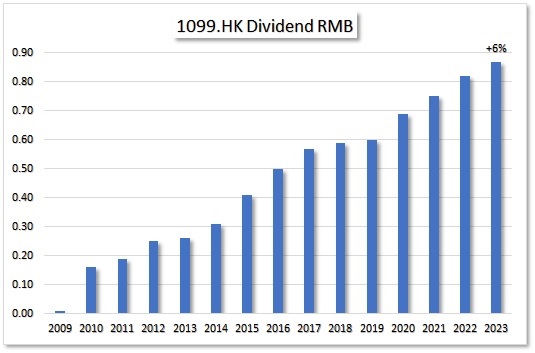

HKG:1099 SINOPHARM

HKG:1099 SINOPHARM Dividend is in RMB also here. Other than that, things look nice. Not too splendid on the yield side , but consistent growth in dividend. So sit and wait till the time is right.