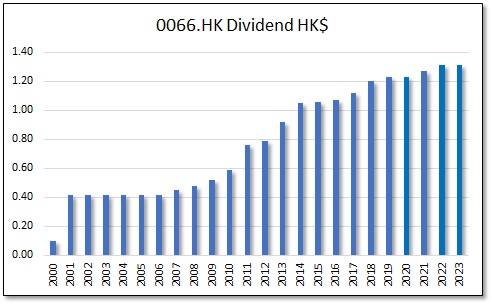

HKG:0066 MTR CORPORATION

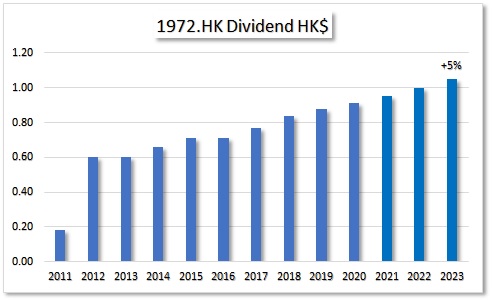

HKG:0066 MTR CORPORATION Look at the beautiful chart. If you are into dividend growth investing, this is what you wish to see. This is a company everybody knows in Hong Kong. MTR Corporation 0066.HK is on the HK exchange since 2000. So far never a dividend decrease.