What makes a good blue chip stock stand out?

Blue chip stocks are popular among investors because they offer stable returns over a long period of time. To determine if a company is a good blue chip stock, investors look for specific characteristics that signal financial strength, stability, and long-term growth potential.In this post we look at what makes a good blue chip stock stand out?

1-Growth.

Investors want to see a track record of steady earnings growth from a company. This means that the company has consistently performed well over a significant period, generating increasing profits year over year. Companies with a proven track record of steady earnings growth are seen as less risky and more reliable investments.

2- Strong Balance sheet.

In addition to steady earnings growth, investors also look for a strong balance sheet, which indicates that the company has a healthy financial position. This includes factors such as a low debt-to-equity ratio, sufficient cash reserves, and a manageable level of debt. A strong balance sheet is seen as a key indicator of a company’s financial stability and long-term growth potential.

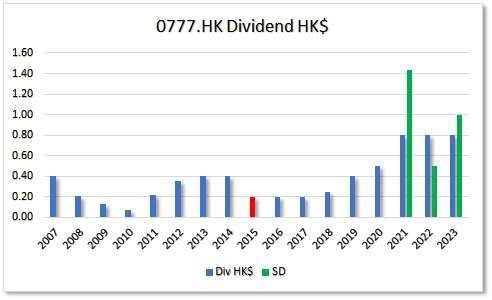

3-Dividends

Another important factor for investors is a history of dividend payments. Dividends are a portion of a company’s profits that are paid out to shareholders, and they can provide a reliable source of income for investors. A company that has a consistent track record of paying dividends is generally seen as more trustworthy and stable, and is often viewed as a safe haven for investors during times of market volatility.

4-A rock solid reputation in the industry.

Finally, a solid reputation in the industry is crucial for blue chip stocks. This includes factors such as brand recognition, customer loyalty, and a positive image among stakeholders. Companies with a good reputation are more likely to attract investors, customers, and talented employees, which can help to drive long-term growth. A strong reputation is also seen as a key asset during times of crisis, as it can help a company weather difficult economic conditions.

Overall, blue chip stocks offer investors a reliable way to build a portfolio that can generate steady returns over time. By looking for companies with a track record of steady earnings growth, a strong balance sheet, a history of dividend payments, and a solid reputation in the industry, investors can make informed decisions and build a portfolio that meets their financial goals and risk tolerance.

Read More:

the Blue Chip Rock stars of Hong Kong

And the USA

|

Sign up for freeand get immediate access to |

|

|

YES, FOR FREE We promise to only send you amazing helpful emails! |