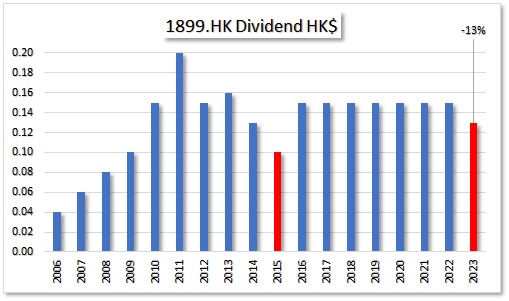

HKG:1899 XingDa Int’l

HKG:1899 XingDa Int’l Xingda International Holdings Limited (1899.HK) is an investment holding company principally engaged in the manufacture and trading of radial tire cords, bead wires and other wires. The radial tire cords are used for trucks and passenger cars. The Company operates its business mainly in China, India, Korea, United States of America and Germany. The Company’s subsidiaries include Jiangsu Xingda, Shanghai Xingda and Xingda International (Shanghai). Through its subsidiaries, the Company is also engaged in commercial property investments.