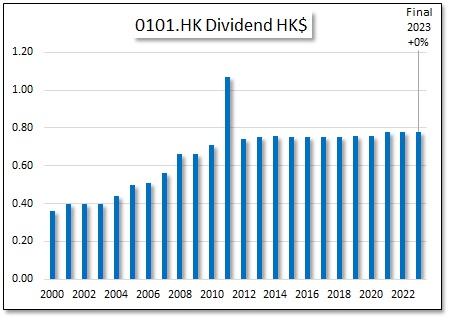

HKG:0101 Hang Lung Properties Hang Lung Properties Ltd (0101.HK) is an investment holding company mainly engaged in property leasing. The enterprise operates its business through two segments. The Property Leasing segment is engaged in the leasing of portfolio of properties carrying the ’66’ brand in Mainland China, including Shanghai, Shenyang, Jinan, Wuxi, Tianjin, Dalian, Kunming, Wuhan, and Hangzhou. It is also engaged in the development and sales of properties in Hong Kong, the property portfolio includes commercial properties, offices and residential and serviced apartments, among others. The Property sales segment engages in the sale of properties in Hong Kong, including units at The Long Beach, semi-detached houses at 23-39 Blue Pool Road.