My Courses

HKG:9987 Yum China

HKG:9987 Yum China This is a company that either owns, franchises, or has a stake in businesses that run restaurants. These restaurants are known as “stores” or “units” and operate under popular brand names like KFC, Pizza Hut, Taco Bell, Lavazza, Little Sheep, and Huang Ji Huang.

HKG:6823 HKT Trust

HKG:6823 HKT Trust This is a company from Hong Kong that gives people communication services. They have three main parts to their business. One part makes sure people can talk on the phone and use the internet. Another part focuses on mobile phone services in Hong Kong. And the last part helps businesses with different…

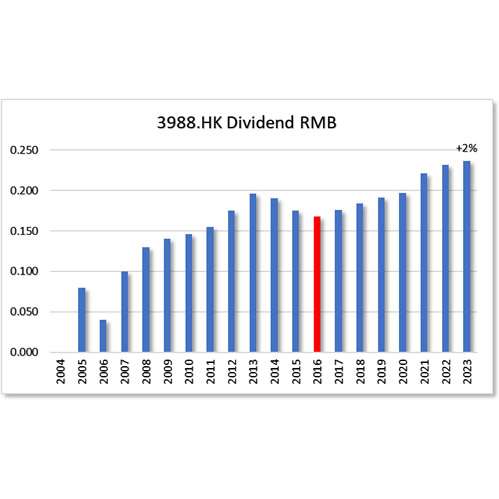

HKG:3988 Bank of China

HKG:3988 Bank of China

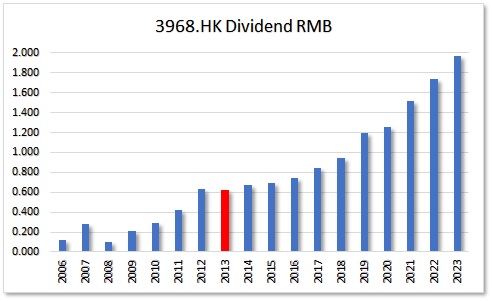

HKG:3968 China Merchants Bank

HKG:3968 China Merchants Bank The principal activities of the Group are the provision of corporate and personal banking services, conducting treasury business, the provision of asset management and trustee services and other financial services.

HKG:3360 FE Horizon

HKG:3360 FE Horizon This is a company that helps people with money-related things. They have two parts of their business. One part helps people with buying and selling things like cars and machines. The other part helps with trading and selling medical equipment and ships.

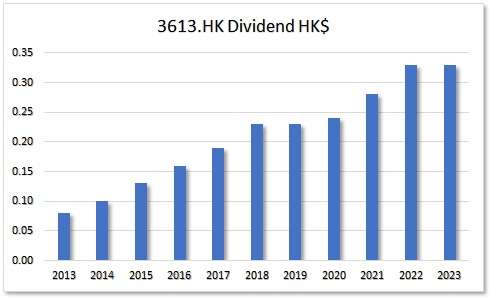

HKG:3613 Tong Ren Tang

HKG:3613 Tong Ren Tang 1H 2022 a special dividend was announced. Final dividend got a raise of 17%. This company is heading to become dividend contender next year. And let’s not forget the beautiful dividend chart. The special dividends is left out conveniently.

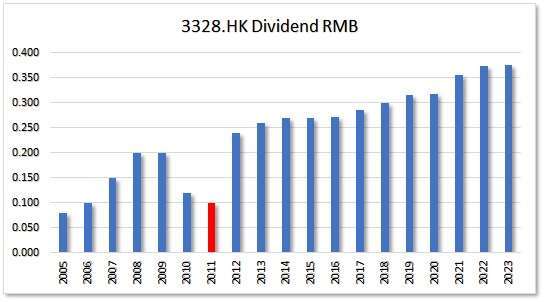

HKG:3328 Bank of Communications

HKG:3328 Bank of Communications This is a company that helps people with their money. They have different parts that do different things. One part helps regular people with loans, saving money, using credit cards, and sending money to other people. Another part helps businesses with loans, paying bills, trading, saving money, and sending money to…

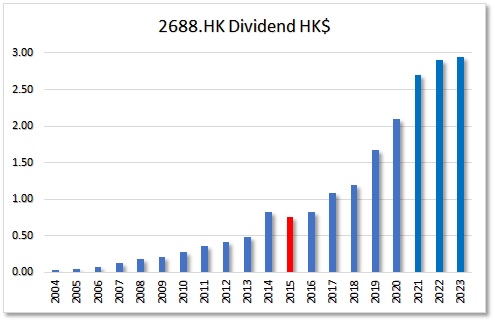

HKG:2688 Enn Energy

HKG:2688 Enn Energy ENN Energy Holdings Limited is an investment holding company principally engaged in gas supply business. The Company is engaged in the sale of piped gas, gas connection, the construction and operation of vehicle gas refueling stations, the wholesale of gas, the sale of other energy and the sale of gas appliances and…

HKG:2669 China Overseas Property Holdings Ltd.

HKG:2669 China Overseas Property Holdings Ltd. China Overseas Property Holdings Limited (2669.HK) is an investment holding company principally engaged in the provision of property management services. This enterprice operates its business through two segments. The Property Management Services segment is engaged in the provision of property management services to mid- to high-end residential communities, commercial…