operates in the field of .

Last update:

- Yield:

- Price/earnings ratio : (Ideal <20 )

- Earnings per share : (Ideal >0.001)

- Price as per : HK$

Sector:

Dividend related metrics

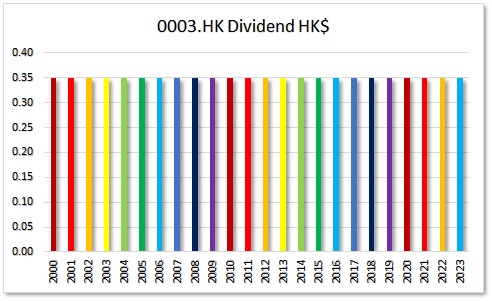

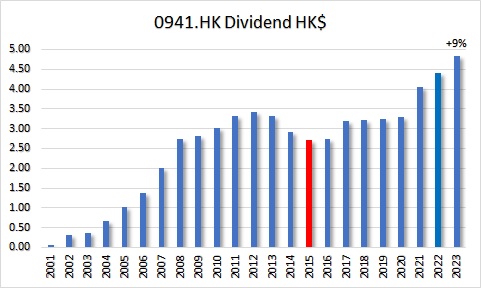

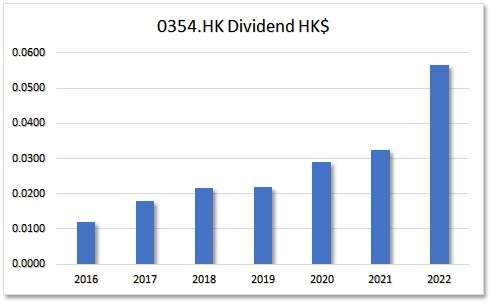

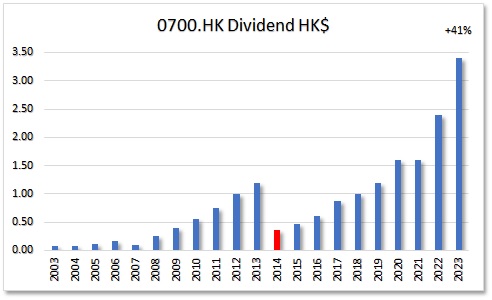

- Dividend since :

- Dividend growth since :

- No of years Dividend Growth:

- That makes this company a

- Payouts/year:

- Payout in the following months : .

- Ex-date :

- Latest dividend announcement:

- Dividend 5 yr average:

Company Performance

- Price/earnings ratio : (Ideal <20 )

- Earnings per share : (Ideal >0.001)

- Dividend payout : (Ideal <50%)

- Dividend Coverage ratio:

- EPS 5 year growth rate :

- Return on Equity:

Dividend Growth related Metrics

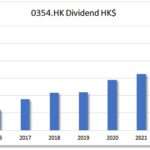

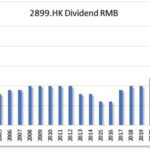

- Average dividend growth 1 year :

- Average dividend growth 3 years :

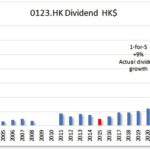

- Average dividend growth 5 years : 22.93% (Ideal >5%)

- Average dividend growth 10 years :

- 10% on costs in how many years:

Price related metrics

- Price as per : HK$

- 52 Week low :

- 52 week high :

- Price to 52 Week Low:

- Price to 52 week high:

- Chowder rule (Yield + 5 yrs average dividend growth) :

- Lot: shares

- Investment, Lot x Price: HKD

- Expected Dividends, Investment x Yield:

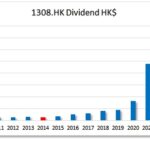

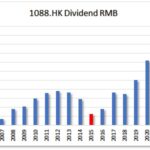

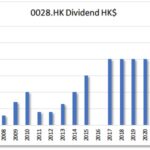

Dividend Report (incl Special Dividends, if any) ,the history, projection on dividend growth and how many year to get 10% Yield-on-Cost

Dividend Stock Screener 1-100, 1 = very bad, 100 = extremely good.

GROWTH Calculated with 7 benchmarks RISK Calculated with 9 benchmarks VALUE Calculated with 9 benchmarks

![]()